6 401k match calculator

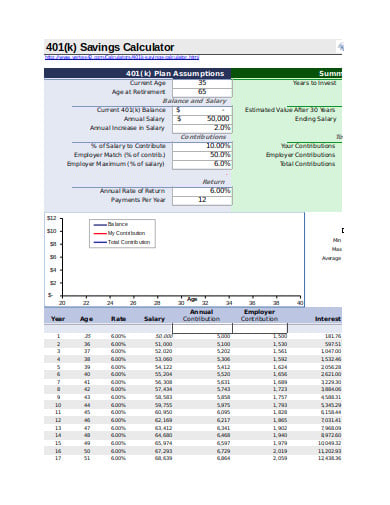

Your hypothetical assumed annual rate of return. See what happens when you increase your contributions.

6 401k Calculator Templates In Xls Free Premium Templates

If you have an annual salary of 100000 and contribute 6 your contribution will be 6000 and your employers 50 match will be 3000 6000 x 50 for a total of 9000.

. Calculator Pros 14 Mile Calculator requires a few sets of data in order to compute your cars quarter-mile elapsed time. Employers are also increasingly recognizing the 401k employer match as a powerful incentive to encourage loyalty to the. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

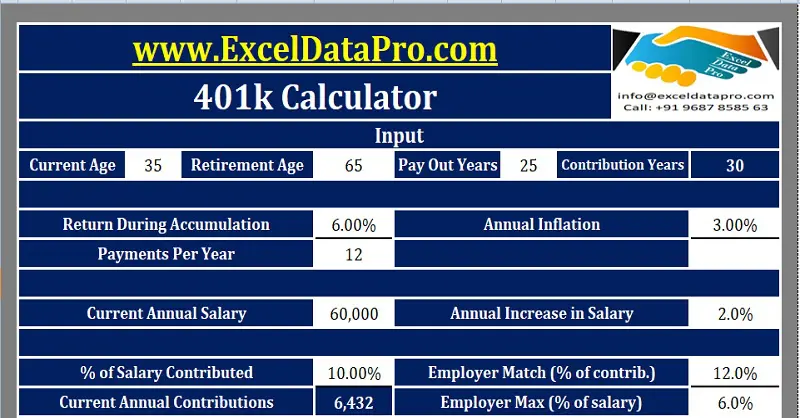

6Percent of Salary Withheld for 401k Monthly box selected 100 and 6 respectivelyEmployer Match Annually box selected 10Years to Fund 401k 11Average Annual Interest Rate Earned Annually box selected Press View Schedule. A Solo 401k plan is a 401k plan for self-employed business owners with no other full-time employees other than the owner and co-owner or spouse if applicable. Unfortunately there are some companies that dont have a 401k plan at.

Youll be taking advantage of dollar-cost averaging tax-deferred growth and a possible company match. The amount of your current account balance. For example lets assume your employer provides a 50 match on the first 6 of your annual salary that you contribute to your 401k.

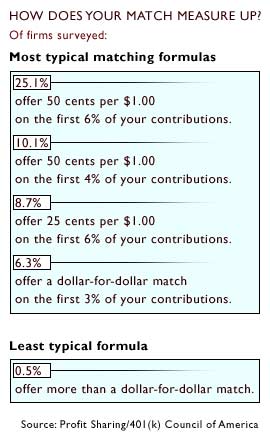

A 401k match is money your employer contributes to your 401k. Employer matching contributions are a common feature of many company 401k plans with 98 of employers adding partial or full matching bonusesThe typical American company is matching 6 of employee contributions in 2022. With this key job benefit your employer adds to the money you save boosting your 401k account over the long term.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. 600 AM to 400 PM PT. Roth 401k Traditional 401k Contributions.

A 401k plan can be a great way to invest giving employees a way to grow their savings tax-deferred until retirement. The money you put in and its growth are not taxed scoreHowever your. Our widget is even customizable so that you can match the.

You will need the following statistics to get started. In 2022 you can invest up to 20500 a year in a 401k 403b or in most 457b plansnot including the employer match. Contributing that same 6 of your salary would.

Keep more money. How to Calculate 14 Mile. The length of time that you anticipate you will invest this money.

A 401k plan gives employees a tax break on money they contribute. Payroll 401k and tax calculators. Pick the best retirement plan for your budget today.

You will have about 171725 in your 401k in 10 years assuming all variables are met of course. You can choose the background color and the style of the widget to match the design aesthetic of your blog. Contribution percentages that are too low or too high may not take full advantage of employer matches.

For example an employer might offer matching contributions of 3 or 6 if an employee chooses to contribute 6 of their salary to the 401k. A 401k is a retirement savings and investing plan that employers offer. In 2022 the total contributions that an employee and employer can make to a 401k cannot exceed 100 of the employees salary or 61000 67500 including catch-up contributions whichever is less.

Matches are not required with Traditional 401ks though most employers match 50 cents on the dollar up to 6 of employee pay or dollar-for-dollar up to 3. Attract talent and match contributions so your team can grow with you. Including 401k the employees share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc.

Thats a lot of money. Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account. The employer-matching funds will belong to you after five years at your job but if you leave your job after three years you will be 60.

Contributions are automatically withdrawn from. Take the same example of a 40000 salary and a 6 limit. Step 7 Use the formula discussed above to calculate the maturity amount of the 401k.

Contributions are made with after-tax dollars that means you pay taxes on that money now. Lets say you have a plan that increases the amount you are vested in your plan each year by 20this is known as graded vestingYou will be fully vested ie. This is the big one.

Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. In this example you would enter 3 percent in the Match Up to field and 5 percent in the Additional Match Up to field to indicate the combined total employer match.

Payroll calculator tools to help with personal salary. Matching is mandatory with a Safe Harbor 401k but there are a few different options. Access affordable 401k plans for small businesses with QuickBooks Payroll.

If the percentage is too high contributions may reach the IRS. If youre 50 or older you can add an additional 6500 per year for a total of 27000. An S-Corp 401k is beneficial in helping business owners contribute income towards retirement in addition to offering valuable tax deductions.

What Happens if I Leave Before I Am Fully Vested in My 401k. Updated October 26 2020. Terms conditions pricing special features and service and support options subject to change.

A case could be made for. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. If you started investing 250 per month at the age of 25 and earned an average annual return of 6 for example youd have 567539 by the time you reached the age of 67.

Step 5 Determine whether the contributions are made at the start or the end of the period. Contributions are made with pretax dollars that lowers your taxable income now but youll pay taxes later in retirement. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Another employer may choose to match 50 of contributions which again is limited to a certain contribution amount.

401k Contribution Calculator Step By Step Guide With Examples

Free 401k Calculator For Excel Calculate Your 401k Savings

What Is A 401 K Match Onplane Financial Advisors

Customizable 401k Calculator And Retirement Analysis Template

A Retirement Calculator Calculates How Much You Need To Save To Ensure A Smooth And Comfortable R Retirement Calculator Financial Calculator Financial Planning

401k Contribution Calculator Step By Step Guide With Examples

Doing The Math On Your 401 K Match Sep 29 2000

Doing The Math On Your 401 K Match Sep 29 2000

401k Employee Contribution Calculator Soothsawyer

Retirement Services 401 K Calculator

Download 401k Calculator Excel Template Exceldatapro

Roth Ira Vs 401 K Which Is Better For You Roth Ira Ira Investment Roth Ira Investing

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Download 401k Calculator Excel Template Exceldatapro

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan